Stranger Things is making you buy Eggos

We all want Stranger Things back… and so does Kellogg (K), apparently. The company enjoyed a 14% average growth jump in the fourth quarter of 2017 and 9.4% in the first four months of this year. This may seem random for a long-struggling brand, but analysts have a theory as to what has strangely caused the resurgence of Kellogg.

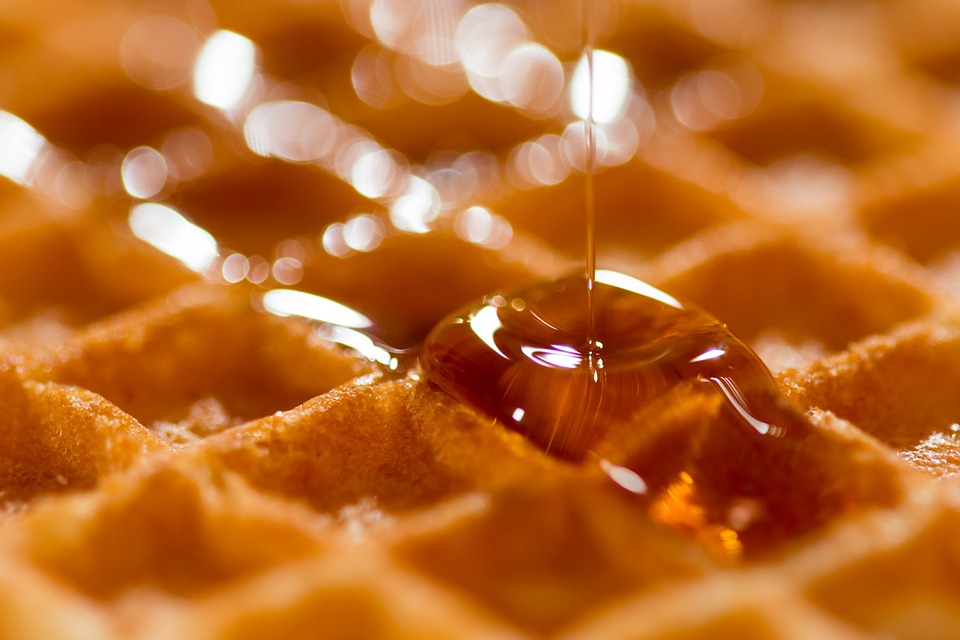

Kellogg can thank Eleven... for her waffle-loving ways. Before the show first aired, there had been a steady decline in demand for Eggo waffles. However, the seemingly forgotten (albeit delicious) breakfast item has been revived overnight. Kellogg even saw the most monthly mentions ever for the brand in October of last year – the same time Stranger Things returned to Netflix for another season.

Nothing new to see here… as most Stranger Things fanatics binged the entire seconds season months ago and the Eggos remain fully stocked in the freezer isle. So Kellogg, and the rest of us, are going to need to wait very patiently for season three – which likely won’t be out until 2019.