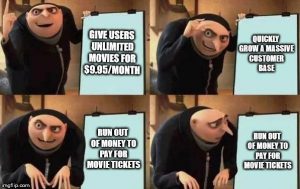

Having trouble saving money? You’re supposed to!

The unemployment rate is low… so that must mean people are earning money and saving money, right? Wrong. One in three Americas has less than $5,000 saved for retirement, and the average person is saving less than 3% of disposable personal income!

You’re workin’ hard… and you have no problem earning money, no problem spending money, but a serious problem saving money. But don’t worry – it’s not your fault. When given equal opportunities to earn or save, our brains do not prioritize saving. We all have an anti-saving bias that keeps us from saving money.

But you’re not a lost cause… because you can learn to change your mindset and start saving! Rather than imagining your future self-saving money, think about how saving money today will benefit your tomorrow. It’s not easy – but it is so worth it.